FBR Digital Invoicing Integration System

Effortlessly connect your business with the Federal Board of Revenue’s digital invoicing platform. Stay compliant, automate tax processes, and focus on growth—tailored for Pakistani retailers, wholesalers, manufacturers, and service providers.

What is FBR Digital Invoicing?

FBR Digital Invoicing is a government-mandated system that requires businesses to generate and report sales invoices electronically to the Federal Board of Revenue in real time. This initiative aims to increase transparency, reduce tax evasion, and modernize business operations across Pakistan. Our integration solution ensures your business meets all FBR requirements with minimal disruption and maximum efficiency.

Key Features

- Real-time invoice generation and submission to FBR

- POS and ERP integration for retail, restaurants, and wholesalers

- Automated tax calculation and reporting

- Secure data transmission and compliance with FBR standards

- Dashboard for monitoring sales, invoices, and tax status

- Support for multiple branches and devices

- Easy onboarding and training for staff

Benefits for Pakistani Businesses

- Stay compliant with FBR regulations and avoid penalties

- Save time with automated invoicing and reporting

- Gain transparency and control over your tax data

- Boost customer trust with official digital receipts

- Access expert support for integration and troubleshooting

Why Choose Our Solution?

- Local Expertise: Deep understanding of FBR regulations and the Pakistani business landscape.

- Seamless Integration: Compatible with leading POS and ERP systems, with minimal disruption to your operations.

- End-to-End Support: From registration to go-live and ongoing compliance, our team is with you at every step.

- Secure & Reliable: Robust data security and real-time FBR connectivity ensure your compliance and peace of mind.

- Customizable: Solutions tailored to your industry, business size, and unique requirements.

- Transparent Pricing: No hidden fees—get a clear, affordable solution for your business.

Industries We Serve

Textile

Tailored invoicing and compliance solutions for textile mills, garment factories, and showrooms.

Manufacturing

Automate tax and invoice processes for manufacturing plants and industrial units.

Logistics and Transportation

Streamline invoicing for logistics companies, transporters, and fleet operators.

Hospitality

Seamless integration for hotels, restaurants, and hospitality businesses.

Construction

Manage project-based invoicing and compliance for construction firms.

Real Estate

Digital invoicing for real estate agencies, developers, and property managers.

Small and Medium Businesses

Affordable, scalable solutions for SMEs across all sectors in Pakistan.

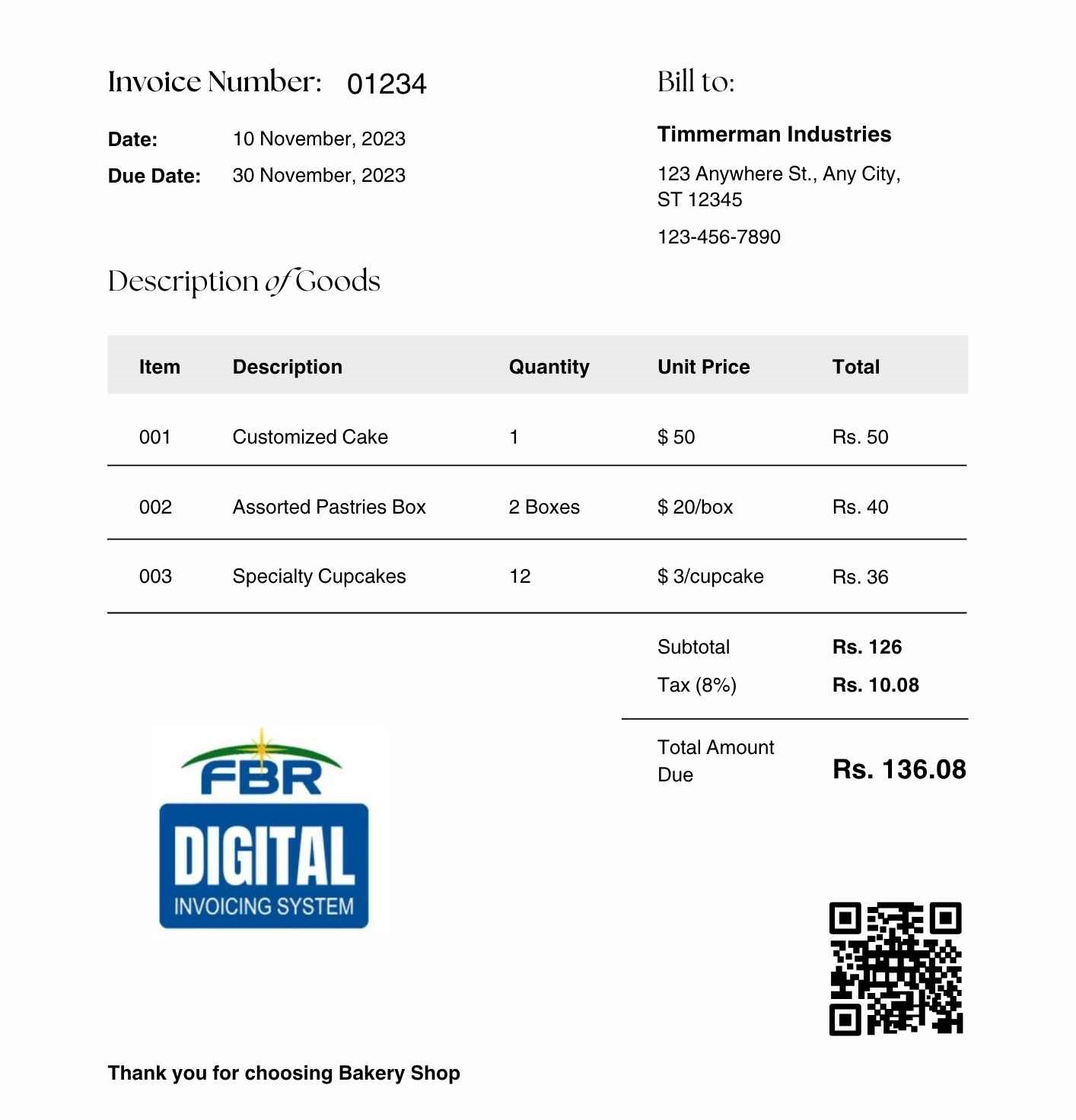

Steps to Implement FBR Digital Invoicing in ERP or POS Software

- Register your business with FBR and get STRN (Sales Tax Registration Number).

- Apply for POS integration through the FBR Taxpayer Portal.

- Get your POS/ERP whitelisted by FBR.

- Obtain FBR credentials (API URL, POS ID, username, password, public key).

- Update your software to generate FBR-compliant invoice format (JSON).

- Integrate FBR API for authentication and invoice submission.

- Send invoices to FBR in real-time and receive response with QR code.

- Print FBR QR code and invoice number on customer receipts.

- Enable offline mode to store and sync invoices later (if needed).

- Test integration in FBR sandbox and then go live.

- Ensure ongoing compliance with FBR reporting and invoicing rules.

Get Started Today

Ready to modernize your business and stay FBR compliant? Book a free consultation with our experts and discover how easy it is to integrate FBR Digital Invoicing with your ERP or POS software. We offer tailored solutions for businesses of all sizes across Pakistan.

Frequently Asked Questions

How long does it take to implement FBR Digital Invoicing?

Implementation typically takes 1-2 weeks, including integration, configuration, and staff training.

Is your solution compatible with my existing POS or ERP?

Yes, our integration works with most leading POS and ERP systems used in Pakistan. Custom integrations are also available.

Will my business data be secure?

Absolutely. We use industry-standard encryption and secure data transmission to protect your business information.

Do you provide ongoing support and updates?

Yes, we offer end-to-end support, including updates as FBR requirements change and technical assistance whenever you need it.

Can I test the integration before going live?

Yes, we provide a sandbox environment for testing and validation before your business goes live with FBR Digital Invoicing.